Author: Savingtipsdaily

Struggling with Car Payments? 9 Essential Steps to Take

A 2023 report from Moody’s Investors Service shows that new auto loan delinquencies are increasing. In the second quarter of 2023, the delinquency rate for new auto loans rose to 7.3%, up from 6.9% in the first quarter. Moody’s warns that delinquencies on both auto loans and credit cards will continue to rise significantly. The…

Explore More

A Comprehensive Guide to Setting Up Your Chase Checking Account

Chase is the commercial banking division of JPMorgan Chase & Co. They offer a range of personal banking services, including credit cards, mortgages, and other financial services to millions of customers. If you’re thinking about opening a Chase checking account, you can do it quickly either online or at a local branch. Here’s a simple…

Explore More

As a Bank Teller, Here Are 7 Bank App Services That Outdo In-Person Transactions

As more banking services shift online and into mobile apps, some might wonder if the role of the neighborhood bank teller is becoming obsolete. However, despite significant investments in digital banking, branch employees like Rachael P., who has been a teller for five years, remain essential. Rachael explains that while many tasks are easier on…

Explore More

How to Steer Clear of the Biggest Pitfall in Managing Your Savings

Managing your savings can be tricky with so many banks and account types to choose from. It’s easy to feel overwhelmed when deciding where to put your money. A common mistake people make is not opting for a high-yield savings account, which can cost you a lot in potential earnings. The national average interest rate…

Explore More

Find Out Your BMO Routing Number

Learn about the routing number for BMO Bank. ### BMO Routing Number The routing number for all BMO personal bank accounts is 071025661. BMO uses this single routing number for all its personal bank accounts, no matter where the account holder lives or which branch they use. This is different from some banks that have…

Explore More

Understanding the Withdrawal and Deposit Restrictions at U.S. Bank ATMs

Sometimes you need to deposit or withdraw a large amount of cash, but you either don’t want to wait in line at the bank or it’s after hours and the bank is closed. Most banks and ATMs have their own limits. Here’s what you need to know about withdrawing and depositing cash at a U.S.…

Explore More

Navigating Chase ATM Limits: Tips for Maximizing Withdrawals and Deposits

Cash is essential, especially when banks are closed and you need it immediately. If you have a checking or savings account with Chase and an ATM or debit card, here’s what you need to know about withdrawing cash from a Chase ATM. ### Chase ATM Withdrawal Limits When you first get your Chase debit card,…

Explore More

Tackling America’s Soaring New Year Credit Card Debt: Strategies for Financial Freedom

As the new year begins, Americans are facing a significant increase in credit card debt, highlighting a troubling trend in personal finance. Recent reports from Bankrate, Transunion, and the Federal Reserve Bank of New York show a notable rise in the number of people carrying credit card balances month-to-month, indicating a worsening debt situation for…

Explore More

Today’s Best CD Rates: June 14 — Earn Up To 5.75% APY

Boost your savings with Merrick Bank’s 6-month CD, offering a competitive 5.40% APY. With a minimum deposit of $25,000, this account is ideal for those looking to maximize their returns. Let’s dive into today’s top CD rates. **Key Takeaways:** – For 3-month CDs, Shoreham Bank leads with a 5.50% APY. – NexBank offers the highest…

Explore More

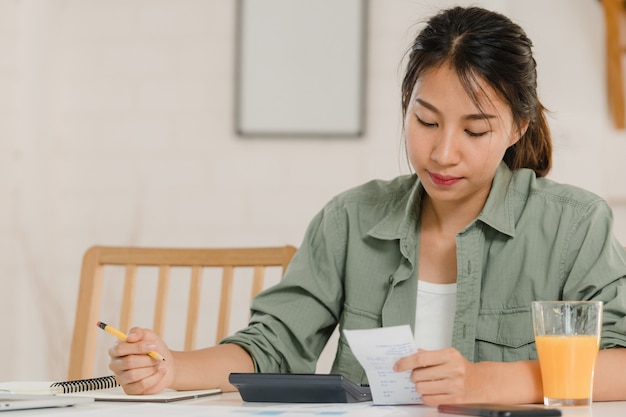

Maximizing Your Financial Management: Optimal Number of Checking Accounts

If you’re trying to stick to a budget, you might have heard about the advantages of having multiple checking accounts. But how many should you actually have? While you can open as many as you want, most financial experts suggest starting with two. ### How Many Checking Accounts Do You Need? Having multiple accounts can…

Explore More