Category: Loans

Strategies to Eliminate $50,000 in Student Loan Debt Within 5 Years

More than 43 million Americans have federal student loan debt, totaling $1.727 trillion according to the Education Data Initiative. On average, each borrower owes $37,088 in federal loans, and when including private loans, the average debt rises to about $39,981. Currently, the typical undergraduate borrows $32,637 to earn a bachelor’s degree at a public university.…

Explore More

Rachel Cruze: A Simple Strategy for Accelerating Your Mortgage Payoff

Owning a home is often seen as a major life milestone, symbolizing stability and success. However, the journey doesn’t stop at just buying a home; achieving financial freedom by paying off your mortgage early is equally important. In a recent episode of The Rachel Cruze Show, Cruze offers valuable advice on how to pay off…

Explore More

A Comprehensive Guide to Refinancing Your Mortgage: Frequency and Key Considerations for Multiple Refinancings

Refinancing your mortgage can help reduce your monthly payments and adjust your loan terms, but it can also be expensive. ### How Many Times Can You Refinance? There’s no legal limit on the number of times you can refinance your mortgage. However, each refinancing comes with closing costs, including inspection fees, title search and insurance…

Explore More

Maximizing Home Equity: Top Strategies for Boomers to Boost Retirement Income

More baby boomers are retiring now than ever before. According to CNBC, the baby boomer generation (those aged 46-64) will reach “peak 65” this year, with over 11,200 Americans turning 65 every day, which amounts to more than 4.1 million annually from 2024 through 2027. Retirement can be an exciting phase of life, but it…

Explore More

Navigating the End of 3 Student Loan Forgiveness Programs: Essential Steps for Financial Relief

President Joe Biden’s initial attempts to pass debt forgiveness legislation were halted by debt-ceiling plans and Supreme Court lawsuits. In response, the administration developed alternatives, including an income-driven repayment (IDR) strategy designed to reduce many borrowers’ monthly payments to $0, known as the Saving on a Valuable Education (SAVE) plan, and a more limited forgiveness…

Explore More

Grant Cardone Foresees 100-Year Mortgages — Is the US Shifting Towards a Rental Society?

Most homeowners typically pay off their mortgage within 15 to 20 years. However, real estate mogul Grant Cardone predicts that mortgage terms could become significantly longer in the future. He believes that the key to America’s financial stability won’t be lower prices but extended mortgage durations. Cardone suggests that in the future, we might see…

Explore More

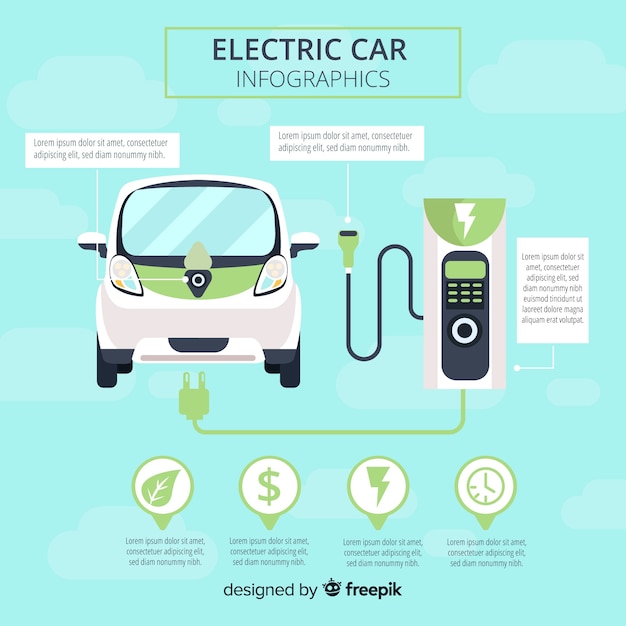

Top 3 Factors Dissuading Consumers from Purchasing Electric Vehicles Even with Reduced Prices and Tax Incentives

The journey to owning an electric vehicle (EV) has become a bit smoother thanks to price reductions and tax credits. Even though tax credits have become stricter since January 1st—requiring EVs to meet more stringent criteria to qualify for the full $7,500 clean vehicle tax credit—they still provide significant assistance for many Americans looking to…

Explore More

Navigating Biden’s Latest Student Loan Forgiveness: Four Essential Steps to Ensure Eligibility

A few days ago, the Biden administration announced that starting next month, the Education Department will expedite student loan forgiveness for those who qualify under the Saving on a Valuable Education (SAVE) plan, an income-driven repayment (IDR) plan. Originally set to begin in summer 2024, the forgiveness will now start sooner for many borrowers. The…

Explore More

Maximize Your Savings with This Mortgage Strategy to Save Hundreds of Thousands

Owning a home is a big part of the classic “American Dream,” but the mortgage that comes with it can feel like a heavy burden, lasting for decades. However, there’s a simple trick that can help you pay off your mortgage faster and save a lot of money: switching from monthly to biweekly payments. ###…

Explore More

Take Advantage of This Mortgage Company’s Limited-Time 2% Interest Rates

High interest rates are still a major hurdle for people trying to get a mortgage and buy a home in 2024. Experts think that rates for a 30-year fixed mortgage might drop to around 6.6% by the end of the year, according to GOBankingRates. However, this is still much higher than the pre-pandemic rates, which…

Explore More